If you make one resolution about improving your accounting procedures in 2013, it should be this: Make extensive use of the tools that QuickBooks offers for report modification. Comprehensive, meticulously-shaped reports that flow out of your carefully-constructed records and transactions are your reward for pounding on the keys every day, conscientiously recording income and expenses.

QuickBooks supplies you with a wide variety of pre-formatted reports whose modification options can help you do focused, critical analysis of your financial data. The right set of numbers will help you understand your history and plan for the future more effectively.

Note: The reports discussed and pictured here shows only one possible set of customization options. There are many variations. We can answer your questions.

Check your preferences

When you created your company file in QuickBooks, you chose between reporting on a cash (income and expenses are recorded when money changes hands) or accrual (recorded when you invoice or receive a bill) basis. This affects summary reports, but not those that break out individual transactions or are simply lists.

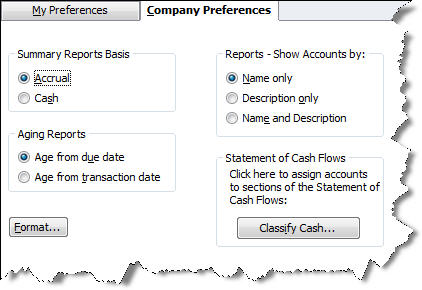

If you want to change this, click Edit | Preferences | Reports & Graphs | Company Preferences and click the desired button:

Figure 1: You can establish a preference for your summary reports’ basis here.

You can set other preferences in this window that will affect your report output here, too, as you can see.

Altering the display

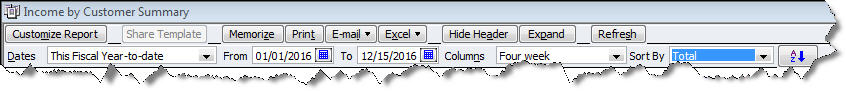

Open the Income by Customer Summary report (Reports | Company & Financial). Change the dates to reflect a range you’d like to see. Want the data displayed by different time increments – like week or quarter – instead of just the total? Click the arrow next to Columns and select Four week.

Figure 2: You can do some report display alterations from this toolbar; the options it offers vary by report.

By default, your report rows display alphabetically. If you want to view a column by total in ascending or descending order, select the column by hovering over the top number until the magnifying glass appears, and click on it. Click the arrow next to Sort by and choose Total, then click the AZ [down arrow] icon (in some reports, there will be other options here).

Additional options in this toolbar let you:

• Memorize the report

• Print, email or export it to Excel

• Hide or Show the Header

• Collapse or Expand the columns

• Refresh the report if you’ve made changes that will alter data

More display options

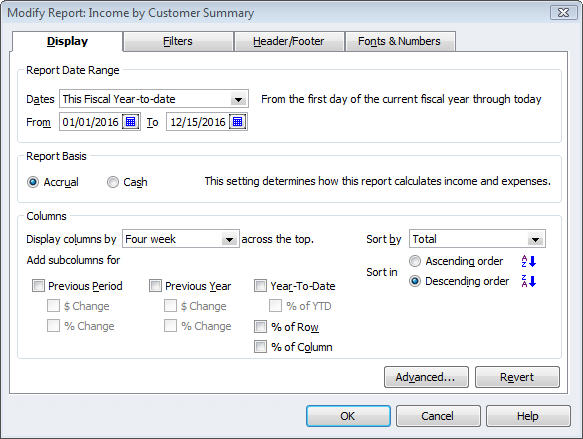

Click Customize Report to open this window:

Figure 3: This window outlines your report’s content options.

Some of the options here duplicate what you saw in the toolbar. In addition, you can switch between Accrual and Cash for just this report, and add subcolumns in some. The latter is a complicated operation, one that you must understand well in order to glean any insight from it. We can help you with this.

Sometimes the subcolumns are generic, as shown in the screen above. In other reports, they’re very specific to that group of data.

Clicking on Revert takes you back to the default format, and Advanced opens additional options specific to the current report.

More customization = more insightful results = more informed financial choices

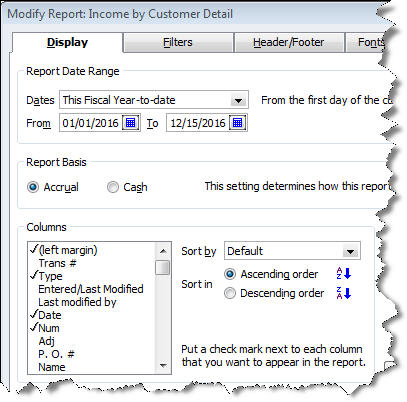

Transaction reports have many similarities and two major differences: You can change the column order by hovering your cursor over the column label until a hand appears. Click, hold and drag the column to the desired spot and let go. You can also add or delete columns by clicking Customize Report and checking or unchecking labels.

Figure 4: In transaction – or detail – reports, you can alter the column structure.

Learn the mechanics of report display modification well, and your company’s finances will come into much sharper focus, improving the wisdom of future choices. Up next month: filtering your reports for additional clarity.

If you have questions on this or any other QuickBooks feature, call or email us. We’re your partner and we’re here to make your business better.